Happy 4th of July!

The Credit Restoration Institute wishes you and your loved ones a fun and safe 4th of July weekend! Check out these family-friendly events happening in Richmond to celebrate the holiday:- Independence Day Celebration and Blast Fireworks : The Diamond | 6:35pm

- Dogwood Dell 4th of July Celebration : Dogwood Dell (Byrd Park) | Time TBD

- 4th of July Fireworks at Kings Dominion : King's Dominion | 9:00pm

Become a CRI Volunteer!

Are you looking for a fulfilling way to contribute to your community? Tired of being cooped up at home and eager to make a difference? Look no further! We have an exciting opportunity for you to join our team as a volunteer and help us create a positive impact on the lives of individuals in need.

If you're interested and would like to know more, click here for more details.

Student Loan Repayment is Restarting

Student loan payments have been paused for three years and even when the U.S. Department of Education discussed starting the payment process again, it never came to fruition. However, Americans now find themselves faced with the reality of a resume. The Education Department website's states that "payments will be due starting in October," and a recent law passed by Congress will make it difficult to bring action against the order.

“For many borrowers, the payment pause has been life altering — saving many from financial ruin and allowing others to finally get ahead financially,” said Persis Yu, deputy executive director at the Student Borrower Protection Center. Roughly 40 million Americans have student loan debt. A typical monthly bill is roughly $350, when the payments start again it is likely many Americans will struggle to adjust.

Click here to read the full article.

Using Credit Cards to Help with Your Summer Vacations

Summer is here and it's time for vacations! Whether you are planning to take a family, solo, or a romantic trip, lately record-breaking inflation rates are causing travel costs and gas prices to dramatically increase, making it more difficult for just about anyone to afford a trip.

Implementing small but mighty steps like limiting unnecessary spending and cutting back on takeout can help save but don’t bypass the benefits your credit cards may offer to help you get away for less. Click the link below to check out these 12 ways credit cards can help you save on a summer vacation.

Read More

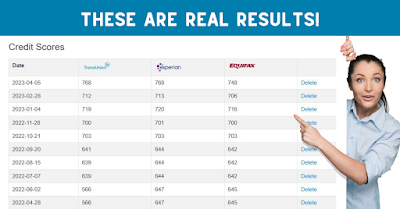

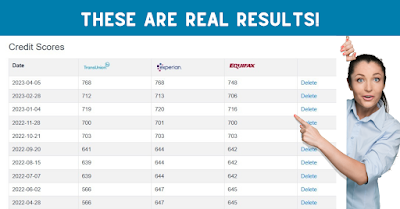

Our custom credit disputes leverage the consumer protection laws and the credit bureaus’ automated codes to help remove or correct unverifiable items.

As our client, we dispute accounts with the bureaus and creditors on your behalf. Using our years of experience, we use the tools you need to move your case forward and get the results you are looking for.

Mortgage readiness and getting pre-approved all imply creditworthiness. You, too, can improve your credit.

As our client, we dispute accounts with the bureaus and creditors on your behalf. Using our years of experience, we use the tools you need to move your case forward and get the results you are looking for.

Mortgage readiness and getting pre-approved all imply creditworthiness. You, too, can improve your credit.

.png)

.png)

.png)

.jpg)

.png)

.png)