A Lesson in Credit Scores

As we're in full swing of the hustle and bustle of the holiday season, it can be easy to fall into the mindset that you have to spend lots of money and buy lots of gifts for your loved ones. This mindset drives 22% of Americans to go into over $550 in debt every year! [source] And if you’re using credit cards, it could potentially be more with penalties, late fees, and finance charges. All of this could lead to damaging your creditworthiness.

While there are some benefits to using credit cards, like cash back bonuses and other incentives, if you don’t feel confident in your ability to pay back the loan, don’t use a card.

Check out our roundup of low-cost gifts that your loved ones are sure to appreciate and stay out of the cycle of debt!

No Cost Gifts

- Create a playlist of your favorite songs and listen to it together.

- Regift an item from your home. Chances are you have something you're not using that a loved one would cherish!

- Make dinner and enjoy conversation and spending time with one another.

- Create a memories jar and write down your favorite memories. When they are missing you they can pull out a memory that makes them smile!

- Give the gift of time nothing is more important that spending time together, why not gift that very thing!

- Offer to babysit if they need a night out free from kids.

- Plan a scavenger hunt that sends them around to all their favorite places!

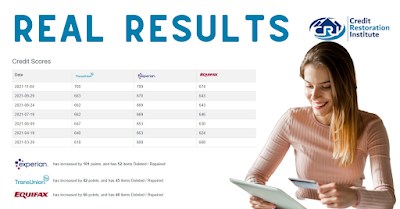

These are REAL results!

Our custom credit disputes leverage the consumer protection laws and the credit bureaus’ automated codes to help remove or correct any unverifiable items.

As a client, we dispute accounts with the bureaus and creditors on your behalf. Using our years of experience, we utilize the tools you need to move your case forward and the results you are looking for.

You too can improve your creditworthiness.

New Federal Debt Collection Rule

It’s been five years coming, but the Consumer Financial Protection Bureau has finalized the two parts of its debt collection rule under the federal Fair Debt Collection Practices Act. This regulation went into effect November 30, 2021.

The new regulation, known as Regulation F, has a number of implications for creditors as well as regulating third-party debt collectors.

Now you may be wondering, how will this affect you? We’re here to help! Get in touch with your questions and we’re happy to answer them.

Give us a call today to start your credit repair journey!

Mon-Fri 9 a.m. - 5 p.m.(804) 823-9601 | (800) 648-5157

mail@creditrestorationinstitute.com