Credit Literacy Curriculum!

Robert Linkonis is on a mission to get credit literacy taught in schools across the country. He is working to create a curriculum that would be taught to high school seniors, explaining more than just financial literacy – like how to balance a checkbook – but also what is credit, how can you build it, and how it can affect your future.

Executive Director of Credit Restoration Institute, a non-profit company assisting individuals in improving their credit score while teaching the impact of creditworthiness and its impact on one’s mental health, Robert is passionate about this topic. "Many people don't know how things will directly affect their credit and the domino effect it can create," says Robert. "A bad credit score can handicap them financially for life." He believes requiring a financial literacy course can eliminate the potential for low credit scores.

Working directly alongside Donna Perkins, Vice President of the National Association of Credit Services Organization (NACSO), Robert, a board member, is developing a curriculum that will not only educate but engage high school seniors to understand the basics of credit. Last month he visited The U.S. Department of Education in Washington, D.C. to lobby for support.

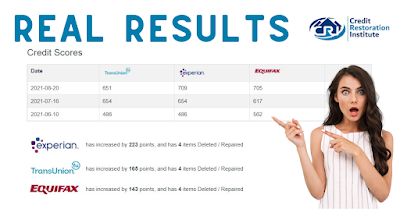

These are REAL results!

Our custom credit disputes leverage the consumer protection laws and the credit bureaus’ automated codes to help remove or correct any unverifiable items.

As a client, we dispute accounts with the bureaus and creditors on your behalf. Using our years of experience, we utilize the tools you need to move your case forward and the results you are looking for.

You too can improve your creditworthiness.

.png)